A Tale of Two Royal Banks

Royal Bank of Canada: 2008 Profit = $5 billion

Royal Bank of Scotland: 2008 Loss = £24.1 billion

Whether measured by market value, balance sheet strength or profitability, Canada's banks are rising to the top. Since the credit crunch began in the summer of 2007, the Big Five banks with a combined asset value in excess of $2.5 trillion - the Royal Bank of Canada, the Toronto-Dominion Bank, the Bank of Noval Scotia, the Bank of Montreal and the Canadian Imperial Bank of Commerce have booked a total of $18.9-billion in profits.

In roughly the same period, the five biggest U.S. banks have lost more than $37-billion (U.S.). One, Wachovia Corp., was forced to sell out to avoid failing. Another, Citigroup Inc., long the world's largest bank, may have to be nationalized and this week became a penny stock.

The picture is even more bleak in Britain. The Royal Bank of Scotland alone lost a staggering £24.1 billion this year, as much as the top five U.S. bank losses put together. I fear for the future of Britain, I really do. What that country had more so than any other country was a mighty financial services industry - London had even boastfully topped New York as the financial centre of the world.

So now what? Unlike Canada, it does not have an abundance of natural resources to guarantee its prosperity, as Britain imports most everything. If its financial system collapses, what does it have to fall back on? I'm very disappointed by this nasty turn of events, as I was preparing my family for the big move to London. Unfortunately we will now be putting off our plans for the long unforeseeable future.

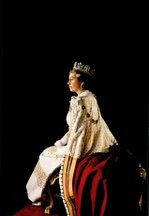

Vice-Regal Saint:

Vice-Regal Saint:

.gif)

.gif)

0 comments:

Post a Comment